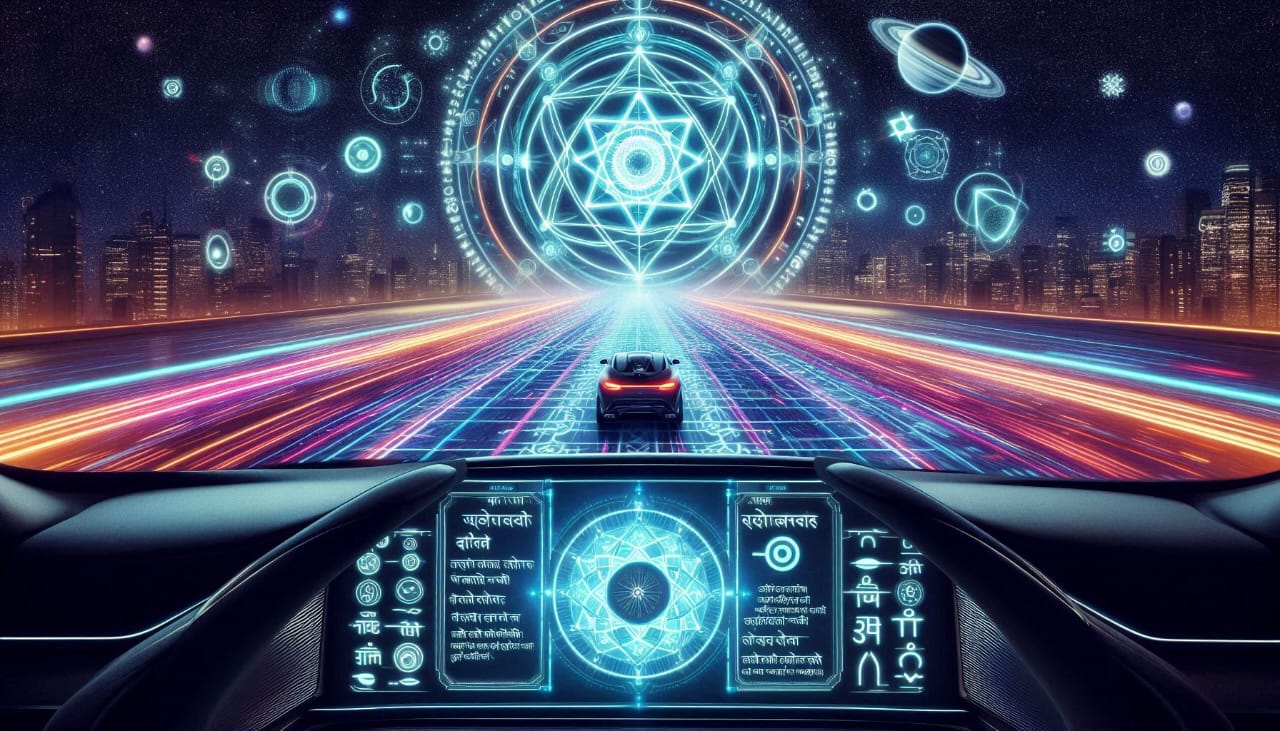

Traditional insurance policies rely on generalized risk factors like age, location, and vehicle type to determine premiums. However, these static models often fail to reflect actual driving behavior. Usage-Based Insurance (UBI) and Behavior-Based Insurance (BBI) are transforming the industry by using real-time telematics data to offer fairer, more personalized pricing.

UBI and BBI leverage telematics devices, mobile apps, and in-vehicle sensors to track key driving metrics such as speed, acceleration, braking, and mileage. By analyzing these factors, insurers can accurately assess risk, reward safe drivers, and prevent fraudulent claims.

For insurers, UBI and BBI models reduce risk exposure and improve pricing accuracy. Fraud prevention becomes easier with verifiable driving data, leading to lower claim costs. For policyholders, these models provide cost savings, real-time feedback, and incentives for safer driving habits.

Adopting UBI and BBI requires seamless integration with existing insurance systems. This involves real-time data processing, AI-driven analytics, and scalable cloud infrastructure. Ensuring compliance with data privacy regulations is also crucial to maintaining customer trust.

As AI, IoT, and 5G technology advance, UBI and BBI will become even more refined. Insurers will gain deeper insights into driving behavior, enabling hyper-personalized policies. The future of insurance is data-driven, and UBI & BBI are at the forefront of this transformation.

Usage-Based and Behavior-Based Insurance aren’t just trends—they are reshaping how insurers assess risk, engage customers, and drive industry innovation.

Sastram Labs is a leading innovator in telematics and insurance technology, dedicated to helping insurers enhance efficiency, risk assessment, and customer engagement.

At Sastram, we empower insurers with telematics to streamline operations, enhance risk assessment, and boost customer engagement.